Currency Pairs: Any

Timeframes: Any

Minimum Deposit: Any

Recommended Account Type: ECN or Raw Spread

Leverage: From 1:30 to 1:1000

Recommend broker: Roboforex

Recommend Vps: GoVPSFX

Do you want to earn automatically and stably 5-10%/month with safe DD? Look here

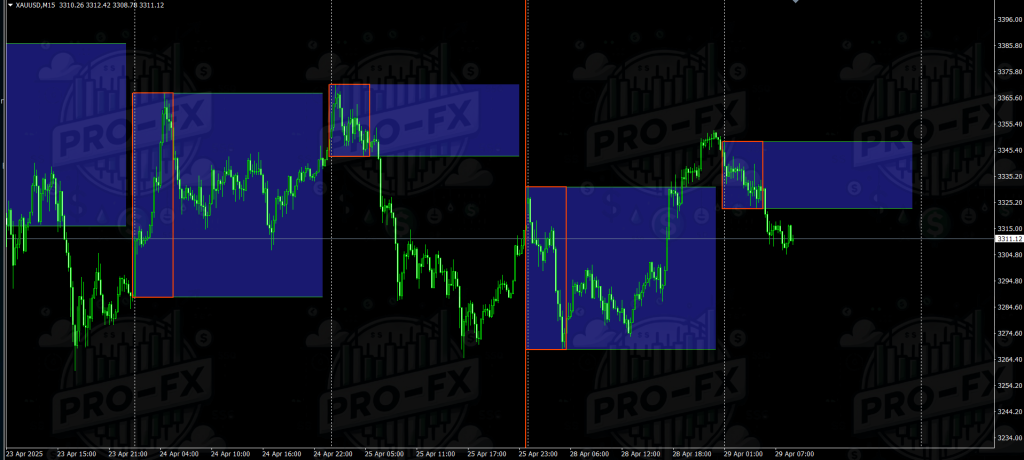

Breakout PANCA EAGLE is a channel indicator for MetaTrader 4 designed for trading on the breakout of the morning flat. It is widely used by Forex traders to identify key support and resistance levels formed during the Asian session and then trade on their breakout, which often coincides with the beginning of the more volatile European session. This approach is based on the “London Breakout” strategy, where after a period of low volatility (Asian flat), the price makes a sharp breakout up or down.

Working hours:

The main focus is on the Asian session (usually from 00:00 to 08:00 broker server time) with subsequent waiting for a breakout at the beginning of the European session (around 08:00–10:00).

Operating principle:

The Breakout PANCA EAGLE indicator forms a horizontal price channel (box) based on the maximum and minimum prices recorded during the Asian session. This channel is displayed on the chart as rectangles, the boundaries of which serve as levels for placing pending orders for a breakout:

– Blue zone (main channel): Defines the price range between the maximum and minimum of the Asian session. This is the main flat zone.

– Green zone: Located above and below the blue zone, it acts as a “noise” buffer warning of a possible imminent breakout.

– Red zone: An area inside the channel where trading is not recommended. The trader should wait for the price to go beyond this zone to make trading decisions.

– Orange vertical lines: Mark the beginning and end of the trading week on Forex, as well as the boundaries of the channel formation period.

A breakout of the level (the price going beyond the blue zone) is interpreted as a signal to enter the market. For example, if the price breaks the upper boundary of the channel, this is a signal to buy (Buy), and if the lower one – to sell (Sell).

Indicator settings:

Breakout PANCA EAGLE provides several parameters for customization, which allows you to adapt it to different trading conditions:

– NumberOfDays: The number of days of history that the indicator will analyze and display on the chart. For weak computers, it is recommended to decrease this value to reduce the load on the terminal.

– PeriodBegin: The start time of the channel formation (usually coincides with the opening of the Asian session, for example, 00:00 broker time). This is the left border of the blue rectangle.

– PeriodEnd: The end time of the channel formation (for example, 08:00, the end of the Asian session). This is the right border of the blue rectangle.

– BoxEnd: The time when all open orders should be closed regardless of profit or loss (for example, 23:59).

– Distance: The distance (in points) from the channel borders, where BuyStop and SellStop pending orders are placed.

– Color settings: Three additional parameters for customizing the colors of the rectangles (blue, green, red) for better visual perception.

Application in trading:

Breakout PANCA EAGLE is used to implement breakout strategies, such as the “London Breakout”. Main steps:

1. **Channel definition**: The indicator automatically builds a channel based on the price range of the Asian session.

2. Order placement: After the channel formation is complete (PeriodEnd), the trader places pending orders:

– BuyStop — at a Distance (for example, 5 points) above the upper border of the channel.

– SellStop — at a Distance below the lower border of the channel.

3. Position management:

– After one of the orders is triggered, the second one is deleted.

– It is recommended to use a trailing stop (for example, 15 points) to lock in profits.

– Minimum take profit: 10-30 pips (depending on the currency pair, for example, for GBP/USD or GBP/JPY).

– Stop loss: Usually set at the opposite border of the channel or at a fixed level (for example, 30 pips).

4. Trading time: Trading is conducted from 10:30 to 21:00 (GMT+7) to capture breakouts at the beginning of the European session and avoid false signals at night.

Tips for use:

– Combination with other indicators: To filter out false breakouts, it is recommended to use additional indicators, such as the 50-period SMA (moving average) on the hourly chart. For example, buy only if the price is above the SMA, and sell if below.

– Risk management: Do not risk more than 5-10% of the deposit per trade. This helps to minimize losses in case of false breakouts.

Reviews

There are no reviews yet.